Does your home insurance really cover your bike?

One of the most frequent questions asked is, “What’s the difference between cycle-specific insurance vs just adding a bike onto your home insurance policy?”

We can understand why this is asked. Often, adding a bike onto your existing home insurance seems like a cheaper option, but are you aware of how the cover differs between the two?

Below is a comparison table between our PLUS cycle insurance policy vs two leading home insurers’ home insurance bike policies.

| Compare our cover | Bikmo | Aviva | Direct Line |

|---|---|---|---|

| Based on our BIKMO PLUS cycle insurance policy | Based on home insurance policy | Based on home insurance policy | |

| Theft from Home | |||

| Theft away from Home | |||

| Accidental Damage | |||

| Public Liability | |||

| Personnal Accident | |||

| Medical Expenses | |||

| Value Limit | £100 min – £30,000 max | £0 min – £5000 max | £0 – £3000 max per bike, £6000 max total |

| Accesories Cover | £250 min or 10% of Total insured value | Included in bike value, only up to value limit | Included in bike value, only up to value limit |

| Clothing + Headgear Cover | £250 min or 10% of Total insured value | None | None |

| 365 Days Worldwide Cover | |||

| Legal Advice | |||

| Race Fee | |||

| Emergency Hire | |||

| Family Cover | |||

| Bike Box Cover | |||

| Excess | £0 Free for Bikmo Replacement option or 10% (min £40) cash | £100 – £1,000 (customer selected) | £100 – £500 (customer selected) |

Disclaimer – Coverage are true as per a web search on 10/10/2023. All coverage is subject to terms and conditions.

Overview

It’s essential to check the level of coverage you have. The last thing you want to do is assume your bikes and kit are adequately covered, to then have a shock if you need to make a claim.

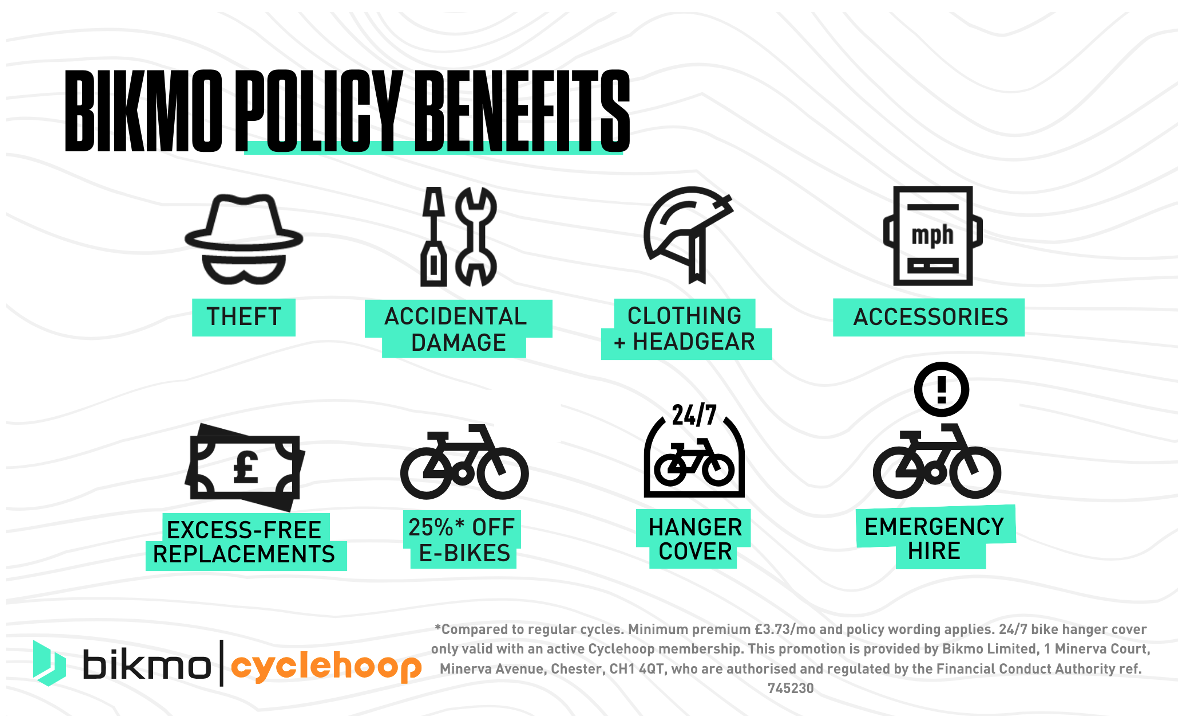

It’s also worth noting that Bikmo offers Cyclehoop Rental customers benefit from an exclusive 10%* discount on their hassle-free insurance policies, some of the benefits which you can see above. Plus, Bikmo also offer a 25% reduction on e-bike premiums compared to regular cycles (including e-cargo bikes!) Simply check your welcome email for how to access this.

If you’re on our waiting list, they also offer a 5%* discount you can access here.

Although not all home insurance policies are the same, here are the important things to look for within policy wording to give you the confidence to make the right decision for your needs.

What home insurance often doesn’t include compared to cycle insurance

Policy wording can often be a minefield to understand. We have made ours as simple as possible; not all insurers do. One area that causes confusion is the cover and exclusions for ‘cycles’.

Read your home insurance policy wording carefully, as you may find that the definition of ‘cycle’ changes to ‘sports equipment while in use’ in the exclusions section. It is important to check this, as it may mean you are not covered while actually riding your bike or when your bike is in a cycle hanger.

Maximum cycle value

With your home contents insurance, there will almost certainly be a limit on the value of cycles, which could be as low as £500.

If your bikes are worth more than this limit, they may need to be specifically declared on a home insurance policy, and they’ll want an additional premium. In many cases, home insurers will decline to provide cover for high value bikes.

Bikmo provides cover for bikes valued up to £30,000!

Cover away from the home

Many home insurers won’t cover you for theft or accidental damage when away from home, unlike a specialist cycle insurer, which is often the time you’d need it.

If you currently cover your bikes under a home insurance policy, it is worth checking the underwriting guide to clarify the details around “away from home cover”.

Check out our handy locking requirements video below and our full locking requirements here:

Accidental damage

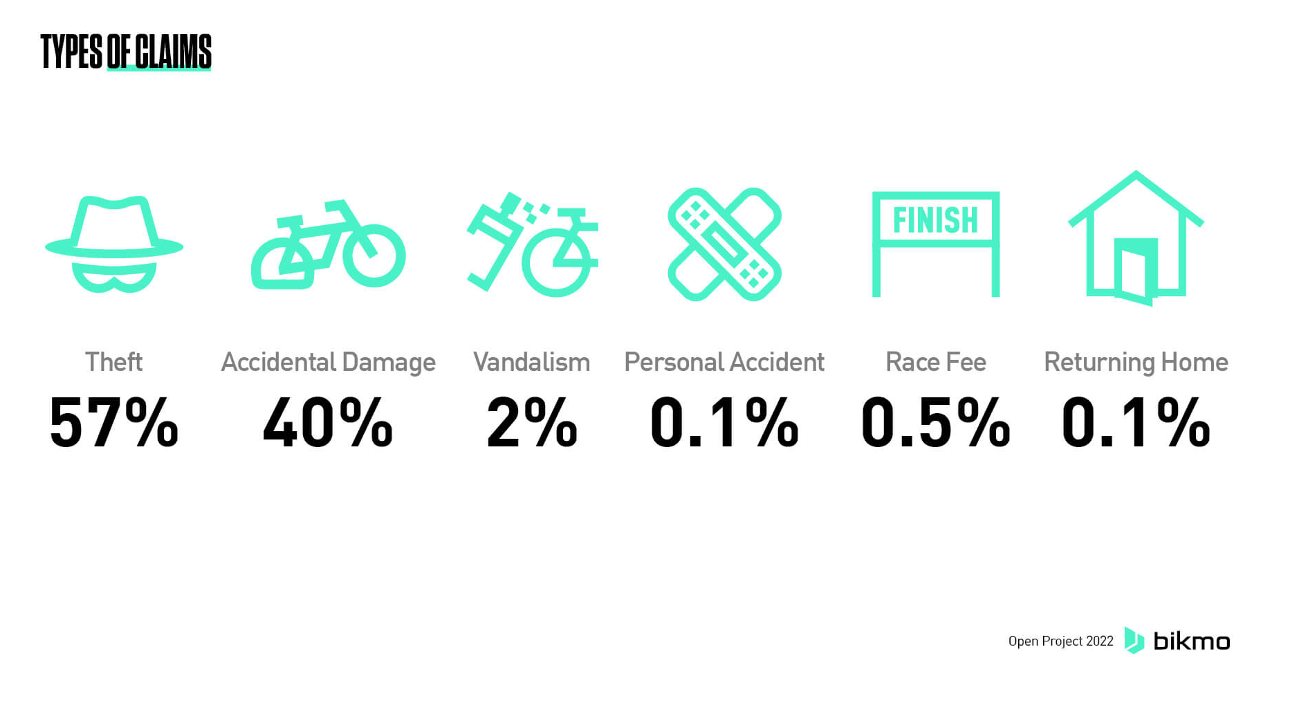

Many cyclists assume it is only theft that they’ll need to be protected against when it comes to cycle cover. However, at Bikmo, 40% of all claims come from accidental damage while riding the bike, a factor many home insurers don’t cover against.

Clothing cover

Helmets, glasses, shoes and other cycling kit can often add up! Clothing is usually the first thing to make contact with the tarmac in a crash. Check the policy wording to see if your other expensive kit is covered.

Home insurance premium increases

Your bikes may be one of the lowest-value items on the home insurance, but that doesn’t mean you won’t be stung with a hefty increase to your annual premium following a claim. Home insurers often increase your premium the following year if you have made a claim.

Home insurance excess fees

When using your insurance, the last thing you want is to be stung with a sizeable excess when claiming. Home insurers often apply high excess fees that can be up to the value of £500.

With Bikmo, where available, you can opt to have £0 excess on bicycle claims when you replace through our retail partners.

Consider dedicated cycle insurance

If you own bikes above £400, commute or use Bikehangers, then you may want to consider cycle specific insurance.

That’s why Bikmo offers straightforward policies to cover you against theft and accidental damage of your bike(s), accessories and much more, worldwide, 24/7.

Plus, Cyclehoop Rental customer benefit from

- An exclusive 10%* discount for Cyclehoop Rentals customers – see your welcome email for details).

- 25% reduction on e-bike premiums compared to regular cycles (including e-cargo bikes!)

+ A 5%* discount for those on the Cyclehoop waiting list (click here!)

Bikmo policy benefits for Cyclehoop Rental customers include:

*Minimum premium £3.73/mo and policy wording applies. 24/7 bike hanger cover only valid with an active Cyclehoop membership. This promotion is provided by Bikmo Ltd Glendale House Sandycroft Industrial Estate Flintshire CH5 2QP, who are authorised and regulated by the Financial Conduct Authority ref. 745230